Transaction Monitoring

Detect the undetectable. With Al clustering algorithms, flag suspicious transactions and safeguard your organisation from potential threats.

Efficiently monitor and detect every transaction with AI insight to safeguard your organization

Our impact in numbers

More than

More than

Discover how our solution can help your business today.

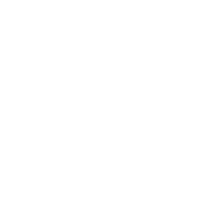

Comprehensive Rule Coverage

With 100+ customizable detection rules, organizations across diverse industries can maximize their risk mitigation and effectively address a wide range of anti-money laundering scenarios.

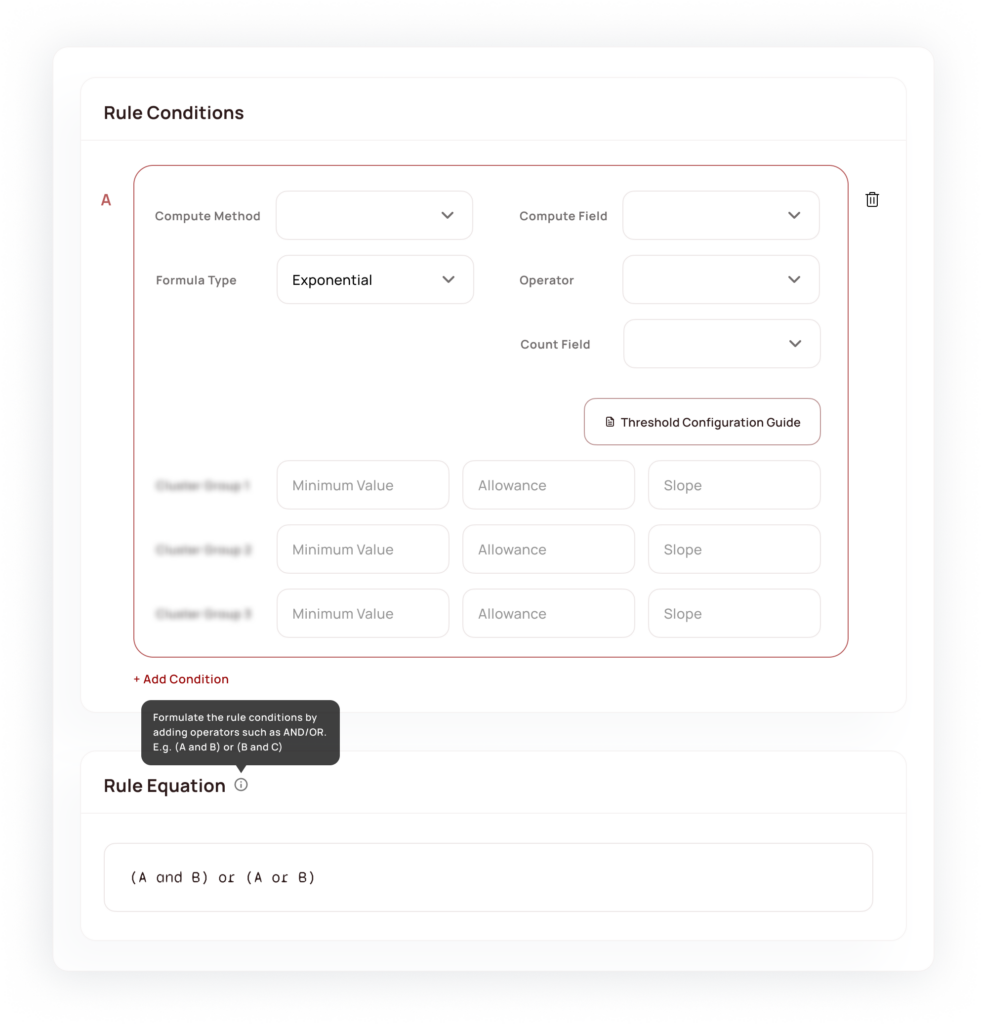

AI-Driven Rule Recommendation

Utilizing AI-driven segmentation allow to dive deep and analyze the customer behavioral transaction pattern providing insights and threshold recommendation for accurate detection while reducing false positive.

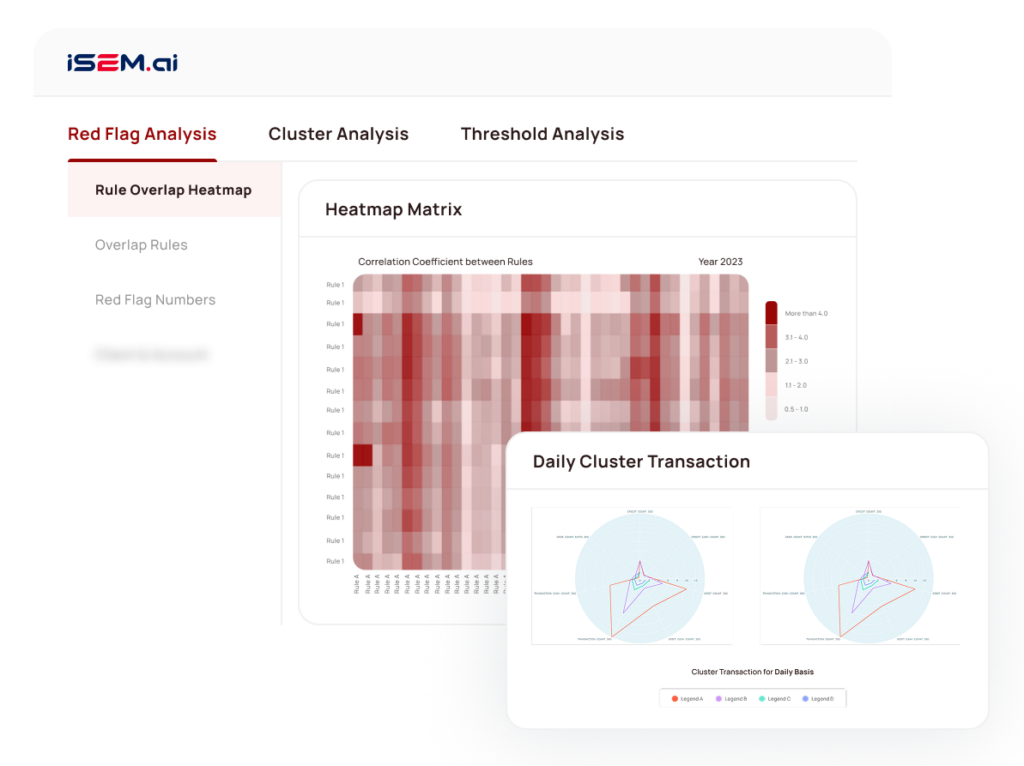

Integrated Sandbox

Forecast the impact of new rules and thresholds by testing potential scenarios and predicting the resulting number of red flags.

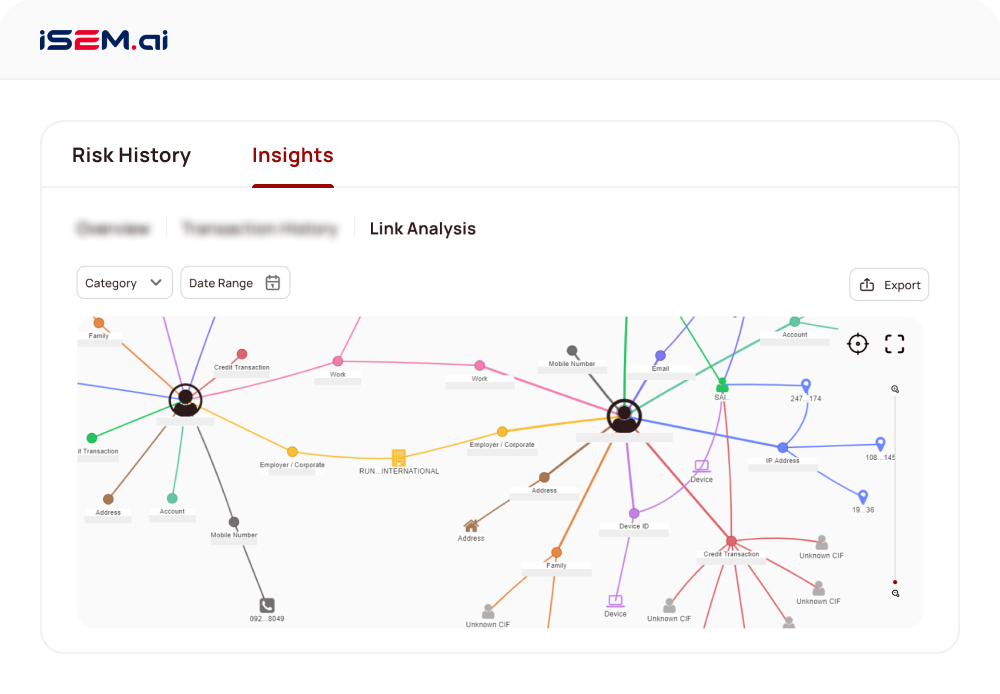

Connecting Dots

Built-in network analytics that dive deep into hidden customer’s relationship and transaction pattern to connect relationship between customers.

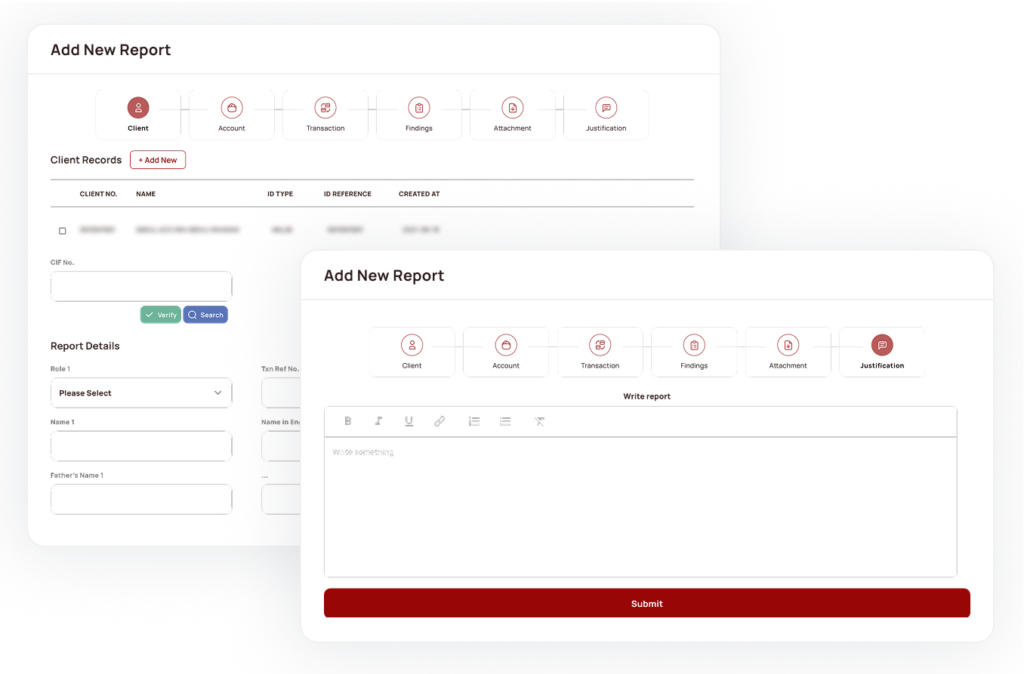

Regulator Reporting

Automate the generation of STR/CTR forms upon investigation. Configure these forms based on your country’s regulatory reporting requirement ensuring compliance with the local regulations.

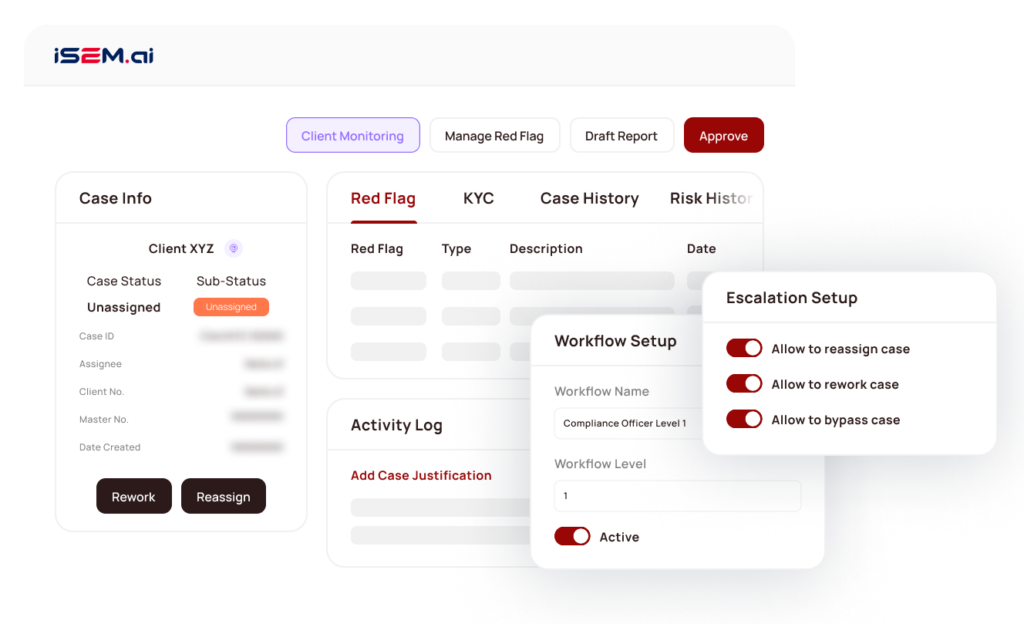

Unified Case Workflow

Designed for both centralized and decentralized workflows, the solution streamlines investigations by eliminating the need for system switching. It provides investigators with the contextual information they need to thoroughly examine cases and make confident, data-driven decisions and file reporting for regulatory purpose.

Definitive Intelligence, Trusted Compliance

From seamless integration to actionable reporting, we leverage cutting-edge AI and machine learning to empower strategic decisions – enabling you to navigate risks with precision, agility, and confidence.

Portfolio

Client Risk Portfolio for Financial Institutions

Gain a centralized, real-time overview of client risk metrics, streamline investigations, and enhance financial crime prevention decisions with actionable insights.

Onboard Monitoring

AI-Powered Onboarding for Financial Crime Prevention

Simplify client onboarding with real-time watchlist screening, risk detection, and regulatory checks, designed for

compliance in Malaysia’s financial sector.

Client Profile Management

AML-Ready Client Profiling & Risk Scoring

Manage evolving customer risk profiles with AI. iSEM.ai helps you track AML activities, identify vulnerabilities, and ensure continuous compliance across financial operations.

Watchlist Monitoring

Watchlist Intelligence for Financial Crime Prevention

Instantly match client data against global watchlists and sanctions databases using AI, eliminating false positives and strengthening regulatory compliance.

Tx Screening

Real-Time Transaction Screening for Clean Compliance

Ensure every transaction complies with AML regulations. iSEM.ai screens data instantly to flag suspicious entries without slowing business operations.

Fraud Monitoring

AI-Driven Fraud Monitoring & Threat Response

Detect fraud in real-time with behavioral analytics and anomaly detection. Automate responses, reduce false positives, and protect your financial operations proactively.

Powered by:

iSEM.ai is an AI-powered platform by TESS International, focused on delivering intelligent financial crime prevention and compliance solutions across Malaysia and Asia.

©2025 iSEM.ai, a product of TESS International.

All rights reserved.