Onboard Monitoring

Start your client relationships with confidence. Our real-time onboarding solution screens against watchlists, identifies risks, and secures smooth, compliant onboarding experiences.

KYC and AML Screening Solutions Malaysia for Fast, Compliant Onboarding

iSEM.ai simplifies client onboarding in Malaysia by combining real-time KYC and AML screening with risk assessment and watchlist matching, ensuring secure and compliant onboarding from the start.

Streamline onboarding with iSEM.ai’s KYC screening platform in Malaysia, combining AML compliance, name screening, and real-time risk assessment

Our impact in numbers

More than

More than

Discover how our solution can help your business today.

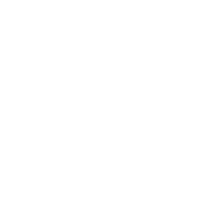

Effective Name Matching

iSEM.ai improves KYC Name Screening Malaysia with precise name matching using client type, gender, and birth year filters. This ensures faster onboarding and reliable compliance results.

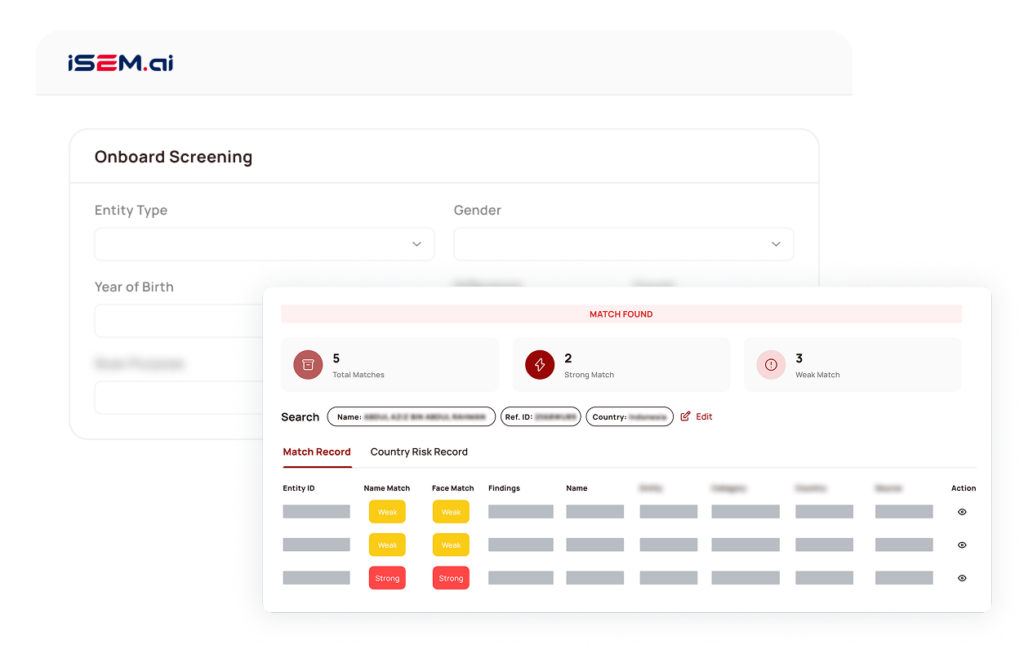

Risk-based Customer Assessment

Tailor customer risk profiles with iSEM.ai’s configurable logic. As part of its KYC and AML Screening Malaysia features, it helps meet compliance standards with confidence.

Multi-System Integration

iSEM.ai connects easily to your existing systems via real-time APIs. This KYC Screening Platform Malaysia enables quick identity checks across workflows without interruption.

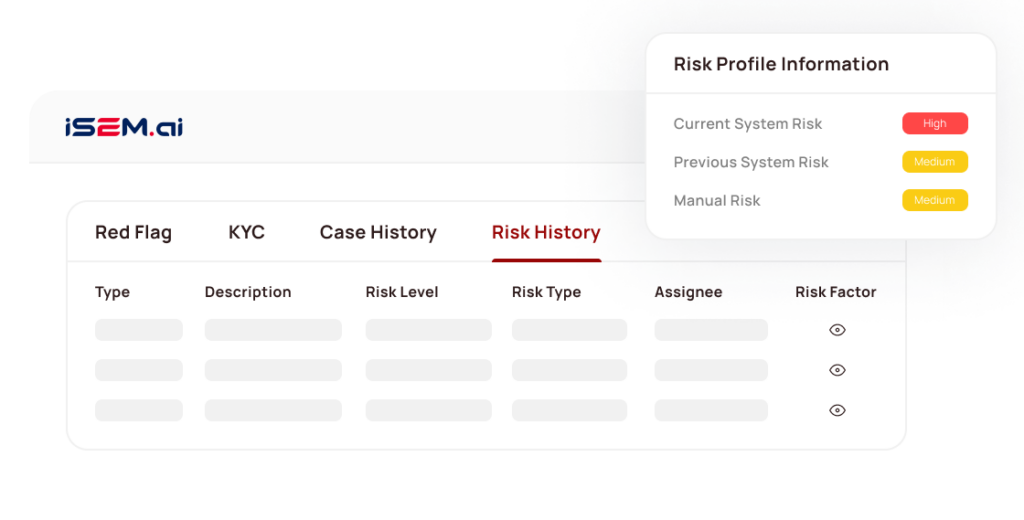

Seamless Case Workflow

Support centralized or decentralized onboarding with structured KYC Screening Solutions Malaysia. iSEM.ai guides teams with clear screening data to simplify decision-making.

Definitive Intelligence, Trusted Compliance

From seamless integration to automated checks, iSEM.ai’s KYC screening platform in Malaysia empowers compliance teams with real-time AML screening and name matching.

Portfolio

Client Risk Portfolio for Financial Institutions

Gain a centralized, real-time overview of client risk metrics, streamline investigations, and enhance financial crime prevention decisions with actionable insights.

Client Profile Management

AML-Ready Client Profiling & Risk Scoring

Manage evolving customer risk profiles with AI. iSEM.ai helps you track AML activities, identify vulnerabilities, and ensure continuous compliance across financial operations.

Watchlist Monitoring

Watchlist Intelligence for Financial Crime Prevention

Instantly match client data against global watchlists and sanctions databases using AI, eliminating false positives and strengthening regulatory compliance.

Tx Monitoring

AI Transaction Monitoring to Detect Suspicious Activity

Leverage clustering algorithms to detect outliers and risky transaction patterns, enabling fast, scalable fraud prevention and AML enforcement.

Tx Screening

Real-Time Transaction Screening for Clean Compliance

Ensure every transaction complies with AML regulations. iSEM.ai screens data instantly to flag suspicious entries without slowing business operations.

Fraud Monitoring

AI-Driven Fraud Monitoring & Threat Response

Detect fraud in real-time with behavioral analytics and anomaly detection. Automate responses, reduce false positives, and protect your financial operations proactively.

Frequently Asked Questions (FAQs)

What is the difference between KYC screening and AML monitoring?

What is the difference between KYC screening and AML monitoring?

KYC screening focuses on verifying the identity of clients and checking them against watchlists such as PEPs and sanctions. AML monitoring, on the other hand, continuously tracks customer behavior to identify suspicious transactions. iSEM.ai offers a unified KYC and AML screening solution in Malaysia, ensuring both identity verification and behavioral analysis are handled in one seamless process.

Is iSEM.ai's onboarding monitoring platform compliant with Malaysia’s regulatory standards?

Is iSEM.ai's onboarding monitoring platform compliant with Malaysia’s regulatory standards?

Yes, iSEM.ai is designed to support compliance with Bank Negara Malaysia (BNM) requirements and other international AML/KYC regulations. Our system is structured to meet local compliance needs, making it one of the most reliable choices for organizations looking for KYC screening solutions in Malaysia.

Can iSEM.ai integrate with our existing onboarding system?

Can iSEM.ai integrate with our existing onboarding system?

Absolutely. iSEM.ai supports RESTful API integration, allowing financial institutions to embed our KYC screening software directly into their existing workflows without disruption. The platform is designed for speed, scalability, and minimal IT overhead.

Who is iSEM.ai suitable for?

Who is iSEM.ai suitable for?

Our platform is built for financial institutions, insurance companies, digital exchanges, and any organization that requires efficient and compliant client onboarding. If you’re seeking a scalable and compliant KYC screening platform in Malaysia, iSEM.ai is built to meet those needs with minimal friction and fast deployment.

Powered by:

iSEM.ai is an AI-powered platform by TESS International, focused on delivering intelligent financial crime prevention and compliance solutions across Malaysia and Asia.

©2025 iSEM.ai, a product of TESS International.

All rights reserved.