Client Profile Management

Stay ahead of risk with dynamic profiles that provide a complete view of client AML activity. Proactively identify and address vulnerabilities in a seamless way.

KYC Risk Assessment & Client Risk Management in Malaysia

iSEM.ai empowers compliance teams with a centralized platform for KYC risk assessment and client risk management in Malaysia. Through real-time data, adaptive scoring and behavioral insights, institutions gain full visibility into evolving customer risks to support smarter decisions and strengthen AML compliance across Asia.

Ongoing KYC Risk Assessment and Customer Lifecycle Monitoring with iSEM.ai

Our impact in numbers

More than

More than

Discover how our solution can help your business today.

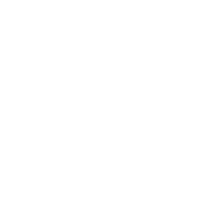

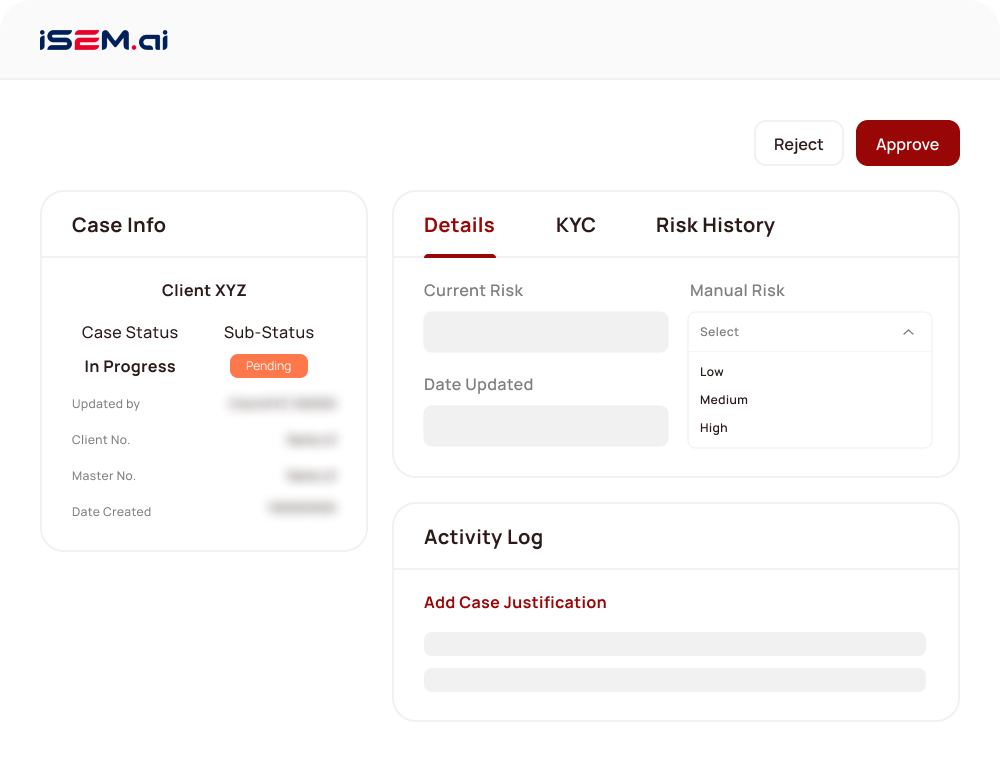

Risk Assessment Engine

Configure risk ratings with iSEM.ai’s flexible risk assessment platform in Malaysia. Set up to 10 custom templates, each with 20 risk categories, to support structured evaluations aligned with your organization’s KYC risk assessment policy.

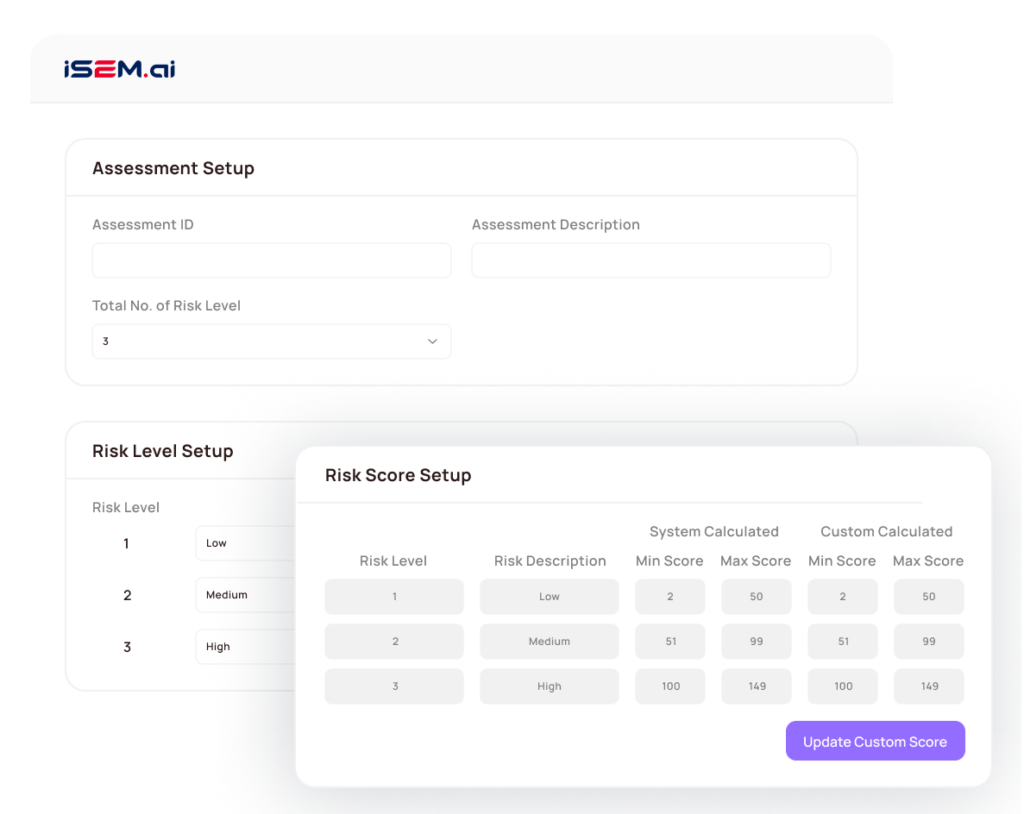

Periodic Ongoing Due Diligence

iSEM.ai helps teams conduct periodic reviews based on customer risk levels. Profiles are updated with fresh data over time, enabling smarter decisions within your risk assessment in KYC workflows and enhancing overall client risk management practices.

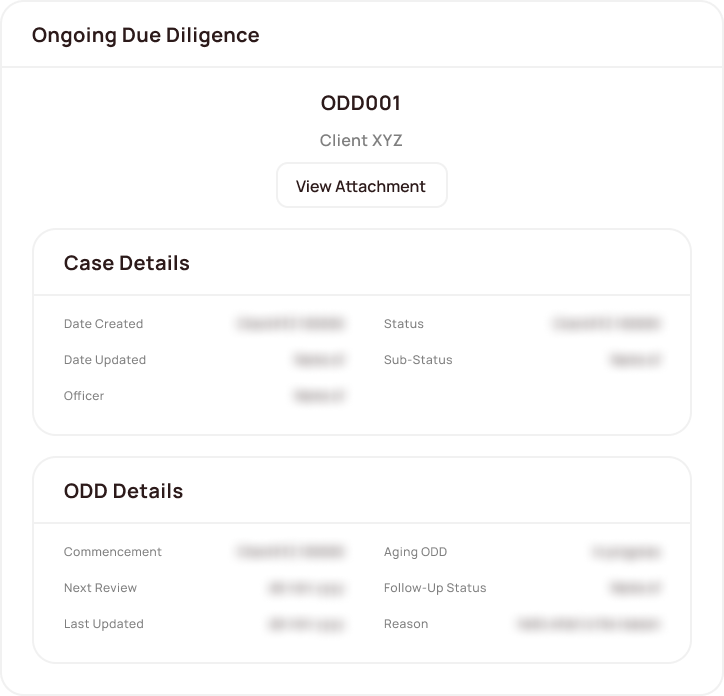

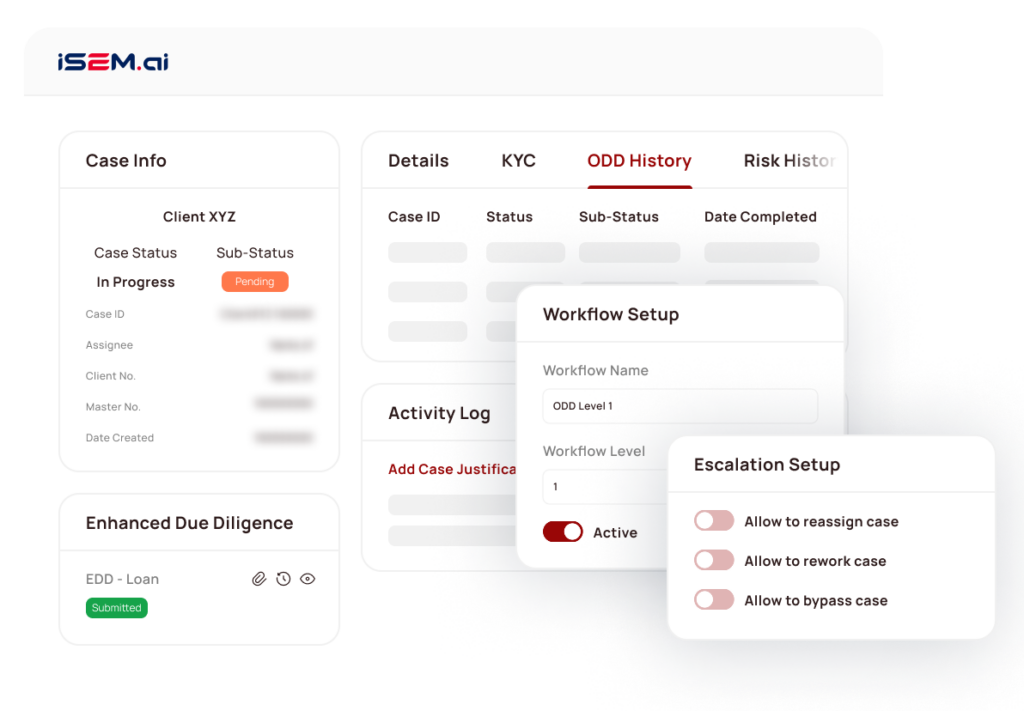

Enhanced Due Diligence (EDD)

Automate EDD document generation for high-risk clients. iSEM.ai allows you to define form logic and data fields based on internal policies, helping strengthen customer risk profile assessment across your compliance framework.

Proactive Risk Management

Stay ahead of risk by tracking behavioral trends, profile changes, and real-time score shifts. iSEM.ai empowers teams to respond early, supporting faster actions and continuous client risk management in Malaysia’s evolving compliance environment.

Unified Case Workflow

iSEM.ai centralizes investigation workflows for flagged clients, whether your team follows centralized or decentralized procedures. The platform ensures consistency and visibility across the entire KYC risk assessment and review lifecycle.

Definitive Intelligence, Trusted Compliance

iSEM.ai delivers end-to-end client risk management with dynamic profiling and real-time alerts. Our risk assessment platform in Malaysia supports KYC risk assessment and automated AML checks for high-risk clients.

Portfolio

Client Risk Portfolio for Financial Institutions

Gain a centralized, real-time overview of client risk metrics, streamline investigations, and enhance financial crime prevention decisions with actionable insights.

Onboard Monitoring

AI-Powered Onboarding for Financial Crime Prevention

Simplify client onboarding with real-time watchlist screening, risk detection, and regulatory checks, designed for

compliance in Malaysia’s financial sector.

Watchlist Monitoring

Watchlist Intelligence for Financial Crime Prevention

Instantly match client data against global watchlists and sanctions databases using AI, eliminating false positives and strengthening regulatory compliance.

Tx Monitoring

AI Transaction Monitoring to Detect Suspicious Activity

Leverage clustering algorithms to detect outliers and risky transaction patterns, enabling fast, scalable fraud prevention and AML enforcement.

Tx Screening

Real-Time Transaction Screening for Clean Compliance

Ensure every transaction complies with AML regulations. iSEM.ai screens data instantly to flag suspicious entries without slowing business operations.

Fraud Monitoring

AI-Driven Fraud Monitoring & Threat Response

Detect fraud in real-time with behavioral analytics and anomaly detection. Automate responses, reduce false positives, and protect your financial operations proactively.

Frequently Asked Questions (FAQs)

What is client profile management in a KYC context?

What is client profile management in a KYC context?

Client profile management is the process of organizing, updating, and monitoring customer data to support ongoing compliance. It plays a critical role in KYC risk assessment Malaysia, helping institutions assess behavioral changes and manage customer risks over time.

How does iSEM.ai support customer risk profiling?

How does iSEM.ai support customer risk profiling?

iSEM.ai enables comprehensive customer risk profile assessment Malaysia through configurable templates and intelligent scoring. It evaluates both static data and real-time signals to generate accurate risk levels that evolve with each customer’s behavior.

Can I customize my KYC risk models based on different customer types?

Can I customize my KYC risk models based on different customer types?

Yes. With iSEM.ai’s modular architecture, you can tailor multiple evaluation frameworks for different client segments. This flexibility enhances your risk assessment in KYC Malaysia by aligning scoring rules with your internal compliance policies.

How does ongoing due diligence work in this platform?

How does ongoing due diligence work in this platform?

iSEM.ai automatically schedules periodic reviews based on a customer’s assigned risk level. These reviews are tied directly to your risk assessment platform Malaysia, ensuring that compliance teams are alerted to material changes in profile data.

Does the platform support both centralized and decentralized workflows?

Does the platform support both centralized and decentralized workflows?

Yes. iSEM.ai is designed to support centralized case reviews and decentralized team structures. This approach improves efficiency in client risk management Malaysia by offering clear task assignment, audit trails, and automated case routing.

Powered by:

iSEM.ai is an AI-powered platform by TESS International, focused on delivering intelligent financial crime prevention and compliance solutions across Malaysia and Asia.

©2025 iSEM.ai, a product of TESS International.

All rights reserved.