Trusted Financial Crime AI Prevention & Solutions Platform Across Malaysia & across Asia

iSEM.ai is a leading financial crime AI detection provider in Malaysia, offering an end-to-end AI platform that detects risks, investigate anomalies, and streamline AML and fraud reporting. Our scalable solution reduces fraud exposure and empowers financial institutions with efficient, real-time compliance tools across KYC, AML, and transaction screening.

How iSEM.ai Empowers Institutions with Smart,

Real-Time Risk Detection

iSEM.ai combines advanced machine learning with behavior-based analytics to give compliance teams deeper insights, smarter alerts and faster response times. The platform is built with flexibility in mind, adapting to evolving risks and helping institutions stay proactive in their financial crime prevention efforts.

One Platform,

Infinite Possibilities.

We Deliver a Tailored AI-Powered Platform for Financial Crime Prevention in Malaysia

Discover our AI solutions built to align with your compliance goals and risk management needs.

Portfolio

Client Risk Portfolio for Financial Institutions

Gain a centralized, real-time overview of client risk metrics, streamline investigations, and enhance financial crime prevention decisions with actionable insights.

Onboard Monitoring

AI-Powered Onboarding for Financial Crime Prevention

Simplify client onboarding with real-time watchlist screening, risk detection, and regulatory checks, designed for

compliance in Malaysia’s financial sector.

Client Profile Management

AML-Ready Client Profiling & Risk Scoring

Manage evolving customer risk profiles with AI. iSEM.ai helps you track AML activities, identify vulnerabilities, and ensure continuous compliance across financial operations.

Watchlist Monitoring

Watchlist Intelligence for Financial Crime Prevention

Instantly match client data against global watchlists and sanctions databases using AI, eliminating false positives and strengthening regulatory compliance.

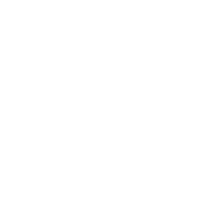

Tx Monitoring

AI Transaction Monitoring to Detect Suspicious Activity

Leverage clustering algorithms to detect outliers and risky transaction patterns, enabling fast, scalable fraud prevention and AML enforcement.

Tx Screening

Real-Time Transaction Screening for Clean Compliance

Ensure every transaction complies with AML regulations. iSEM.ai screens data instantly to flag suspicious entries without slowing business operations.

Fraud Monitoring

AI-Driven Fraud Monitoring & Threat Response

Detect fraud in real-time with behavioral analytics and anomaly detection. Automate responses, reduce false positives, and protect your financial operations proactively.

Why iSEM.ai is your Trusted Financial Crime AI Detection Platform

iSEM.ai is a trusted provider of AI-powered financial crime detection solutions in Malaysia, offering scalable tools for AML compliance, KYC screening, and real-time fraud monitoring. We help institutions stay compliant and proactive in a fast-evolving regulatory landscape.

AI-Powered Financial Crime Prevention for Regulated Industries in Malaysia

Banking & Microfinance

Significantly improved the banking sector by efficiently identifying and combating financial crimes, safeguarding the financial system’s integrity and enhancing customer trust.

Investment Banking

Detecting and preventing the illegal movement of funds across borders, ensuring transparency and integrity in international trade transactions.

Trade Finance

Detecting and preventing the illegal movement of funds across borders, ensuring transparency and integrity in international trade transactions.

Remittance

Effectively identifying and thwarting illicit financial activities, ensuring compliance with regulations and maintaining the security of cross-border money transfers.

Luxury Watches & Jewelry

Tracing and preventing illicit financial activities, safeguarding the reputation and integrity of luxury brands.

Insurance

Mitigating the risks associated with fraudulent claims, thereby reducing loss ratios and ensuring fair premiums for policyholders.

Digital Exchange

Ensuring that any exchanges made digitally are not tainted by illegal activities, fostering investor confidence and trust.

Our products and services are certified by

Frequently Asked Questions (FAQs)

What is iSEM.ai and how does it help with financial crime prevention in Malaysia?

What is iSEM.ai and how does it help with financial crime prevention in Malaysia?

iSEM.ai is an AI-powered compliance platform designed to help organizations in Malaysia detect and prevent financial crime. It supports onboarding screening, transaction monitoring, and fraud detection, making it a reliable solution for financial crime prevention across Asia.

How is iSEM.ai different from other financial crime detection platforms?

How is iSEM.ai different from other financial crime detection platforms?

Unlike rule-based systems, iSEM.ai combines machine learning with regulatory logic to deliver more accurate alerts and fewer false positives. As a trusted financial crime AI detection provider in Malaysia, we empower compliance teams with intelligent automation and local support.

Is iSEM.ai compliant with Malaysian regulations?

Is iSEM.ai compliant with Malaysian regulations?

Absolutely. iSEM.ai is designed to comply with AMLA, FATF guidelines, and Bank Negara Malaysia’s requirements. Our platform ensures that your financial crime prevention AI efforts align with both local and international standards.

Can iSEM.ai adapt to different industries and risk profiles?

Can iSEM.ai adapt to different industries and risk profiles?

Yes. iSEM.ai is built to serve multiple regulated industries, including banking, remittance, insurance, and digital assets. Its modular design allows teams to tailor workflows and risk scoring, making it ideal for implementing scalable financial crime prevention solutions in Malaysia.

Explore iSEM.ai’s AI-Powered Platform for Financial Crime Prevention

See how iSEM.ai transforms your compliance process with intelligent automation and real-time risk detection. Book a demo today.

Powered by:

iSEM.ai is an AI-powered platform by TESS International, focused on delivering intelligent financial crime prevention and compliance solutions across Malaysia and Asia.

©2025 iSEM.ai, a product of TESS International.

All rights reserved.