Watchlist Monitoring

Eliminate guesswork with AI-powered monitoring. Instantly match against global watchlists and public data, reducing false positives and focusing on what matters most.

Comprehensive KYC And AML Watchlist Monitoring Malaysia Solutions

iSEM.ai delivers an end-to-end watchlist monitoring solution in Malaysia, combining global sanctions, PEPs, and internal lists into a single platform. Our system supports KYC and AML screening with intelligent filtering, helping compliance teams reduce operational workload while meeting regulatory expectations with confidence.

Enhance compliance with smart AML and KYC watchlist monitoring in Malaysia, reducing false positives with intelligent screening

Our impact in numbers

Up to

Up to

More than

Discover how our solution can help your business today.

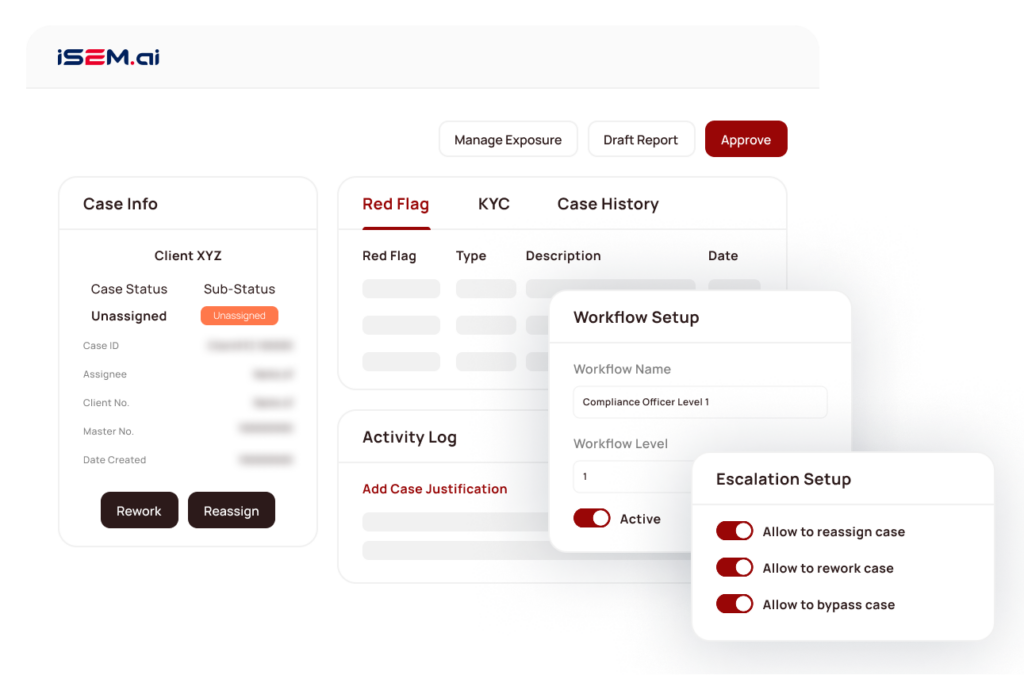

Unified Case Workflow

iSEM.ai supports centralized and decentralized investigations on a single platform. Investigators gain full watchlist context without switching systems, streamlining AML watchlist screening Malaysia processes.

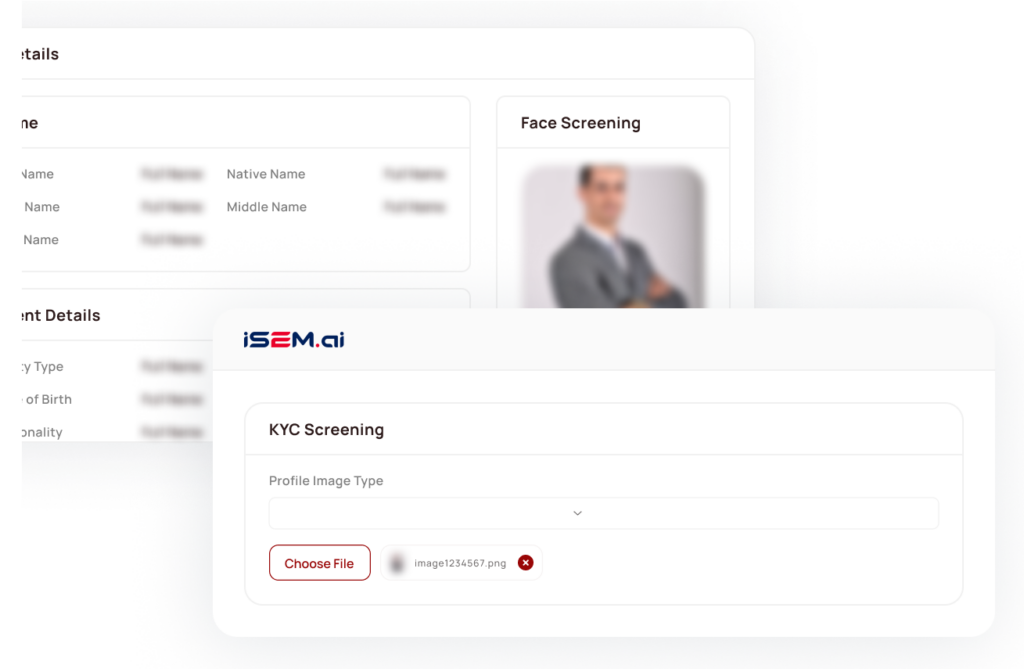

Biometric Matching

iSEM.ai enhances KYC watchlist monitoring Malaysia by verifying identity traits through facial recognition. This added layer improves match accuracy and strengthens compliance workflows.

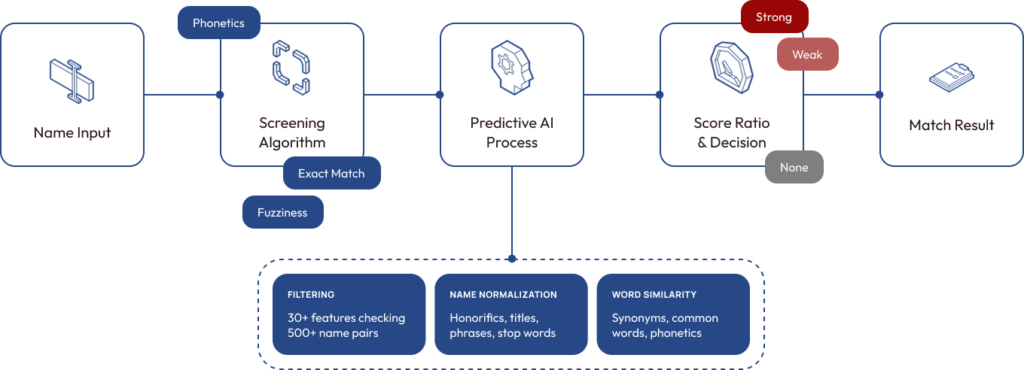

Cross Language Name Matching

iSEM.ai improves watchlist monitoring in Malaysia by detecting names across

different languages and scripts. Institutions can identify high-risk individuals with greater accuracy in multilingual environments.

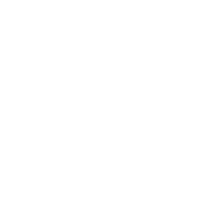

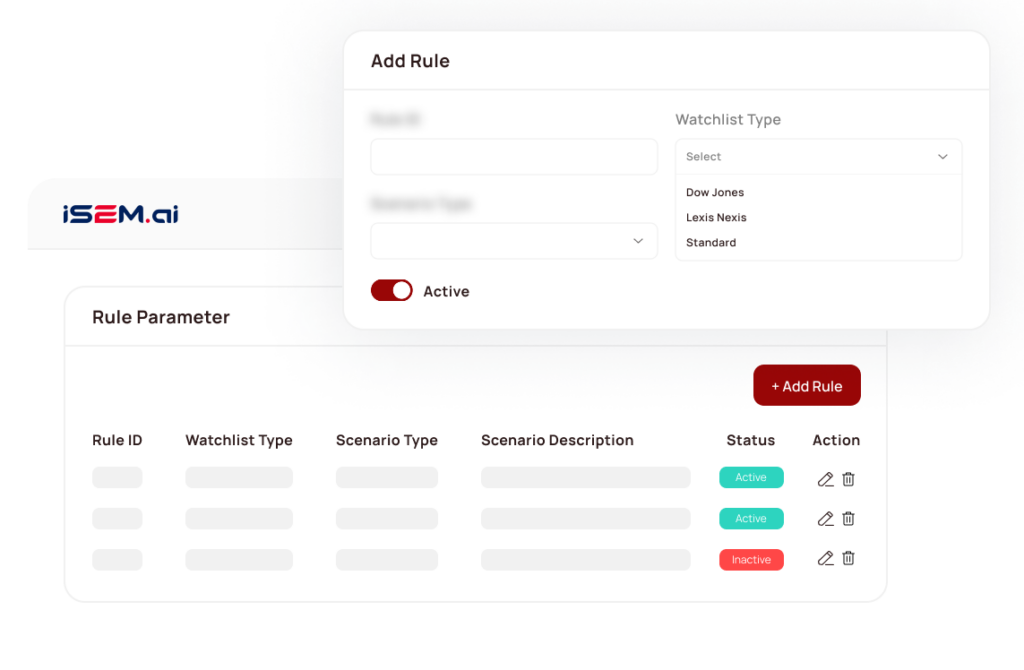

AI Match Scoring and Filtering

To reduce false positives, iSEM.ai applies intelligent scoring that accounts for aliases and spelling errors. The system supports AML watchlist screening Malaysia while aligning with regulatory standards.

Complete Watchlist Coverage

iSEM.ai unifies internal and external watchlists, sanctions, and PEP data in one place. This simplifies KYC and AML screening workflows in Malaysia and improves visibility across compliance teams.

Definitive Intelligence, Trusted Compliance

iSEM.ai delivers intelligent watchlist monitoring in Malaysia, helping institutions automate AML watchlist screening and improve KYC compliance accuracy.

Portfolio

Client Risk Portfolio for Financial Institutions

Gain a centralized, real-time overview of client risk metrics, streamline investigations, and enhance financial crime prevention decisions with actionable insights.

Onboard Monitoring

AI-Powered Onboarding for Financial Crime Prevention

Simplify client onboarding with real-time watchlist screening, risk detection, and regulatory checks, designed for

compliance in Malaysia’s financial sector.

Client Profile Management

AML-Ready Client Profiling & Risk Scoring

Manage evolving customer risk profiles with AI. iSEM.ai helps you track AML activities, identify vulnerabilities, and ensure continuous compliance across financial operations.

Tx Monitoring

AI Transaction Monitoring to Detect Suspicious Activity

Leverage clustering algorithms to detect outliers and risky transaction patterns, enabling fast, scalable fraud prevention and AML enforcement.

Tx Screening

Real-Time Transaction Screening for Clean Compliance

Ensure every transaction complies with AML regulations. iSEM.ai screens data instantly to flag suspicious entries without slowing business operations.

Fraud Monitoring

AI-Driven Fraud Monitoring & Threat Response

Detect fraud in real-time with behavioral analytics and anomaly detection. Automate responses, reduce false positives, and protect your financial operations proactively.

Frequently Asked Questions (FAQs)

What is Watchlist Monitoring in iSEM.ai and how does it work?

What is Watchlist Monitoring in iSEM.ai and how does it work?

iSEM.ai’s Watchlist Monitoring module enables organizations to screen individuals and entities against global watchlists, PEPs, and sanctions lists in real-time. This helps ensure compliance with KYC and AML regulations while reducing false positives and operational overhead.

Does iSEM.ai support KYC Watchlist Monitoring in Malaysia?

Does iSEM.ai support KYC Watchlist Monitoring in Malaysia?

Yes. iSEM.ai is tailored for the regulatory needs in Malaysia, and its KYC watchlist monitoring features are designed to help financial institutions meet local compliance standards, including real-time screening during onboarding and periodic reviews.

How is AML Watchlist Screening different from standard name checks?

How is AML Watchlist Screening different from standard name checks?

Our AML watchlist screening goes beyond basic name matching. iSEM.ai uses advanced matching logic, fuzzy filtering, and noise reduction techniques to reduce false positives while maintaining high detection accuracy for risky entities.

Can I integrate Watchlist Monitoring into my existing onboarding system?

Can I integrate Watchlist Monitoring into my existing onboarding system?

Yes. iSEM.ai offers API-based integration to embed watchlist monitoring Malaysia features seamlessly into your onboarding, transaction monitoring, or case investigation systems – ensuring uninterrupted workflows.

Powered by:

iSEM.ai is an AI-powered platform by TESS International, focused on delivering intelligent financial crime prevention and compliance solutions across Malaysia and Asia.

©2025 iSEM.ai, a product of TESS International.

All rights reserved.