Tx Monitoring

Discover smarter rule scenarios with our AI-powered clustering algorithm that pinpoint truly suspicious activity and provide insights for your team to perform effective investigation and report suspicious transaction.

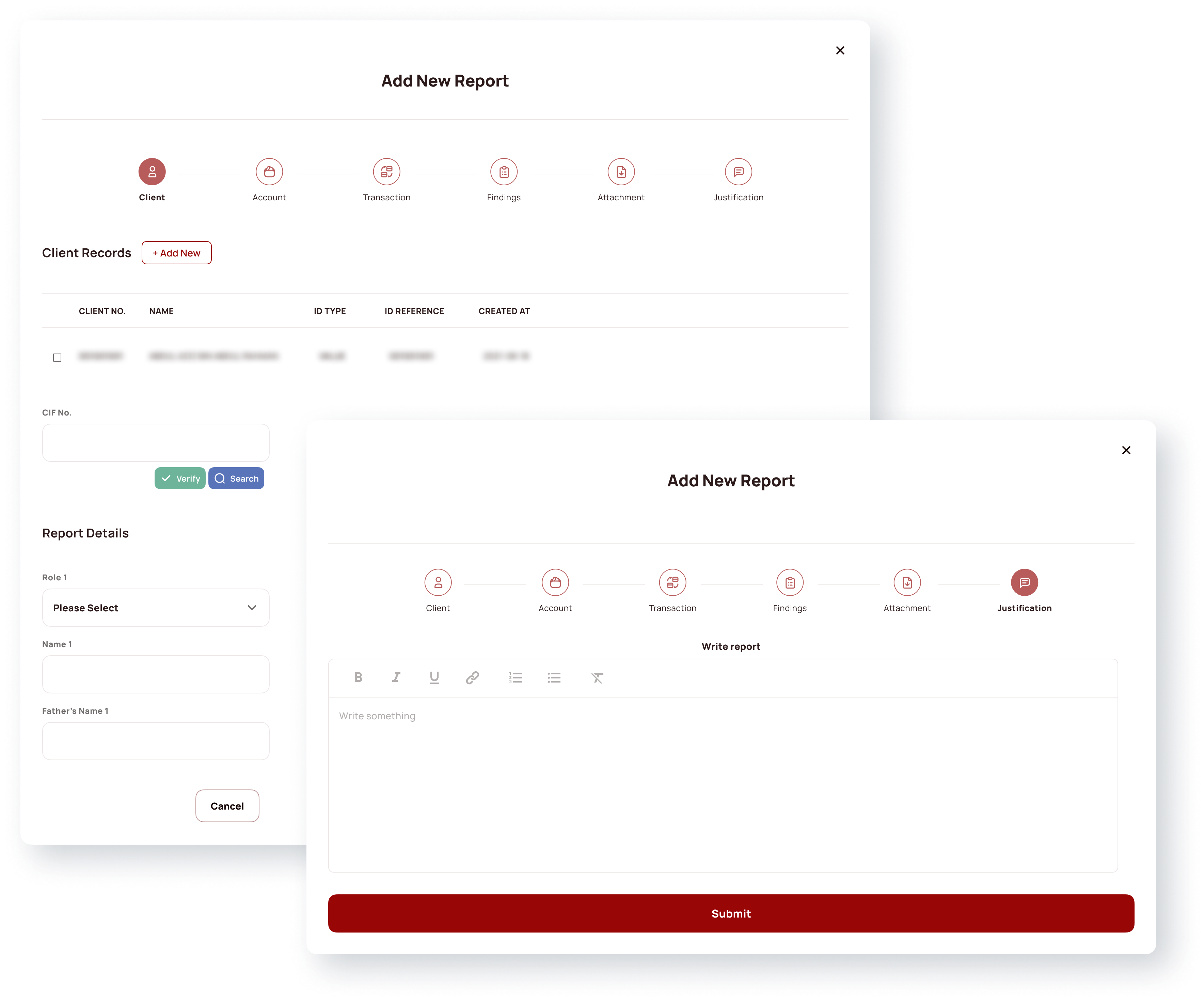

Detect & Report

Monitor any transaction for red flags with advanced AI analytics to complement transaction monitoring.

AI Segmentation

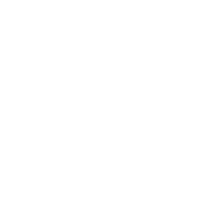

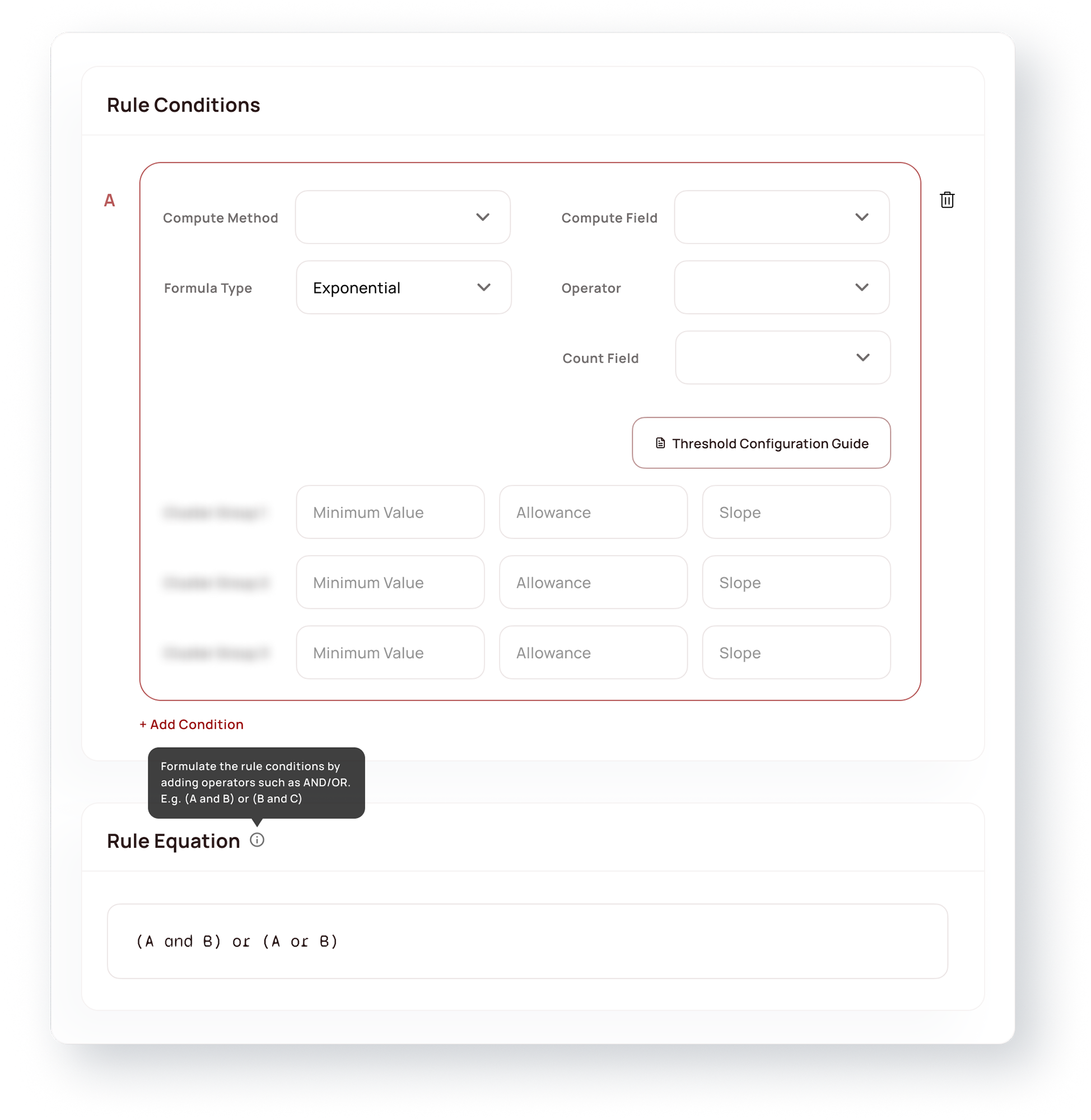

Conduct and train with AI/ML in a sandbox to cluster client’s threshold for effective rule building.

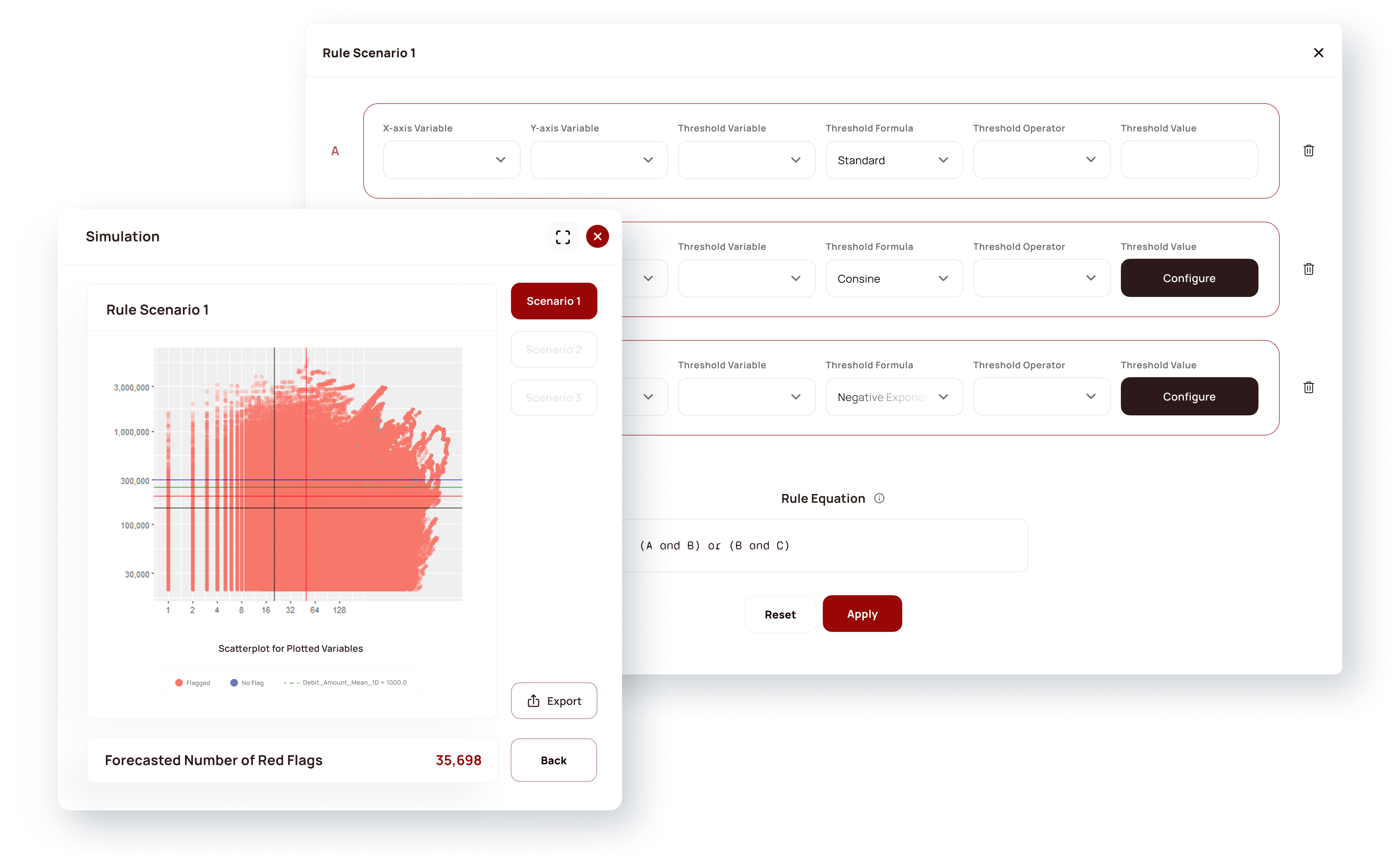

Unified Case Workflow

Single case workflow for on-going monitoring review to improve resources efficiency.

Rule-based Detection

Define and build rule with no-code configuration at own convenience.

STR/CTR Filing

Allow to draft STR or CTR report and save in AML database or extract to regulator report format.

Transforming AML compliance with Tx Monitoring.

Reduce false positives

Significantly reduce the number of false positive red flags while pinpoint true positive, allowing investigators to priority on genuine cases while increase their resources productivity.

Improve operational efficiencies

Streamline all red flag into single case allowing a holistic view of the case information resulting to lower bottleneck and increase investigation efficacy.

Regulator Compliant

Stay ahead with the ever-changing industry and regulatory requirement with our AI and ML models are consistently retrain and provide insights on the existing rule health to ensure ongoing compliance and reduce the need for costly change system.

Start with our Tx Monitoring today.

Explore our other solutions

Portfolio

Transform your AML investigations with the all-in-one hub for effortless red flag management. The overview of client profiles and red flags empower your team to prioritize potential suspicious red flags and eliminate investigation redundancy while boosting operational efficiency.

Onboard Monitoring

Perform in real-time on your client onboarding process against watchlist and risk profile to make rapid decisions about onboarding the client on the go will create smooth onboarding process for your institution.

Client Profile Management

Provide seamless and comprehensive individual AML risk profile for each client on periodic basis to ensure continuity of risk-based approach for ongoing risk assessment and enhanced risk assessment.

Watchlist Monitoring

AI-powered screening engine on clients or entities against premium and public watchlist with the predictive machine-learning model help to reduce false positive and pinpoint true threats.

Tx Screening

Perform in real-time on your transactional data against watchlist or keywords to make rapid decisions about the transactions allow to proactively mitigate risk associated with cross-border payments and boost sanction compliance.

eKYC

Experience frictionless onboarding with automated verification process. The AI-powered delivers rapid decisions on identify verification and KYC solutions, keeping your digital onboarding secure and compliant without the hassle.

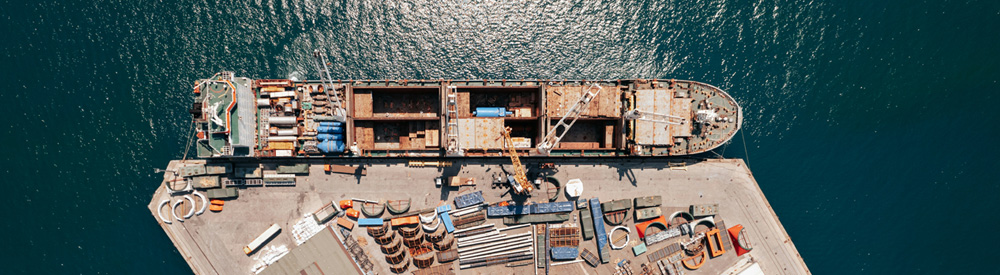

TradeAML

Discover TradeAML, the real-time solution that revolutionizes trade finance compliance. Experience unmatched security with our detailed, ongoing screening and enhanced transaction monitoring. TradeAML safeguards your business by ensuring legitimate trades flow seamlessly while stopping fraud in its tracks.