TradeAML

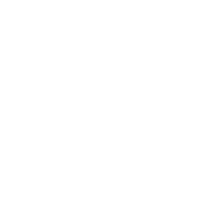

Discover TradeAML, the real-time solution that revolutionizes trade finance compliance. Experience unmatched security with our detailed, ongoing screening and enhanced transaction monitoring. TradeAML safeguards your business by ensuring legitimate trades flow seamlessly while stopping fraud in its tracks.

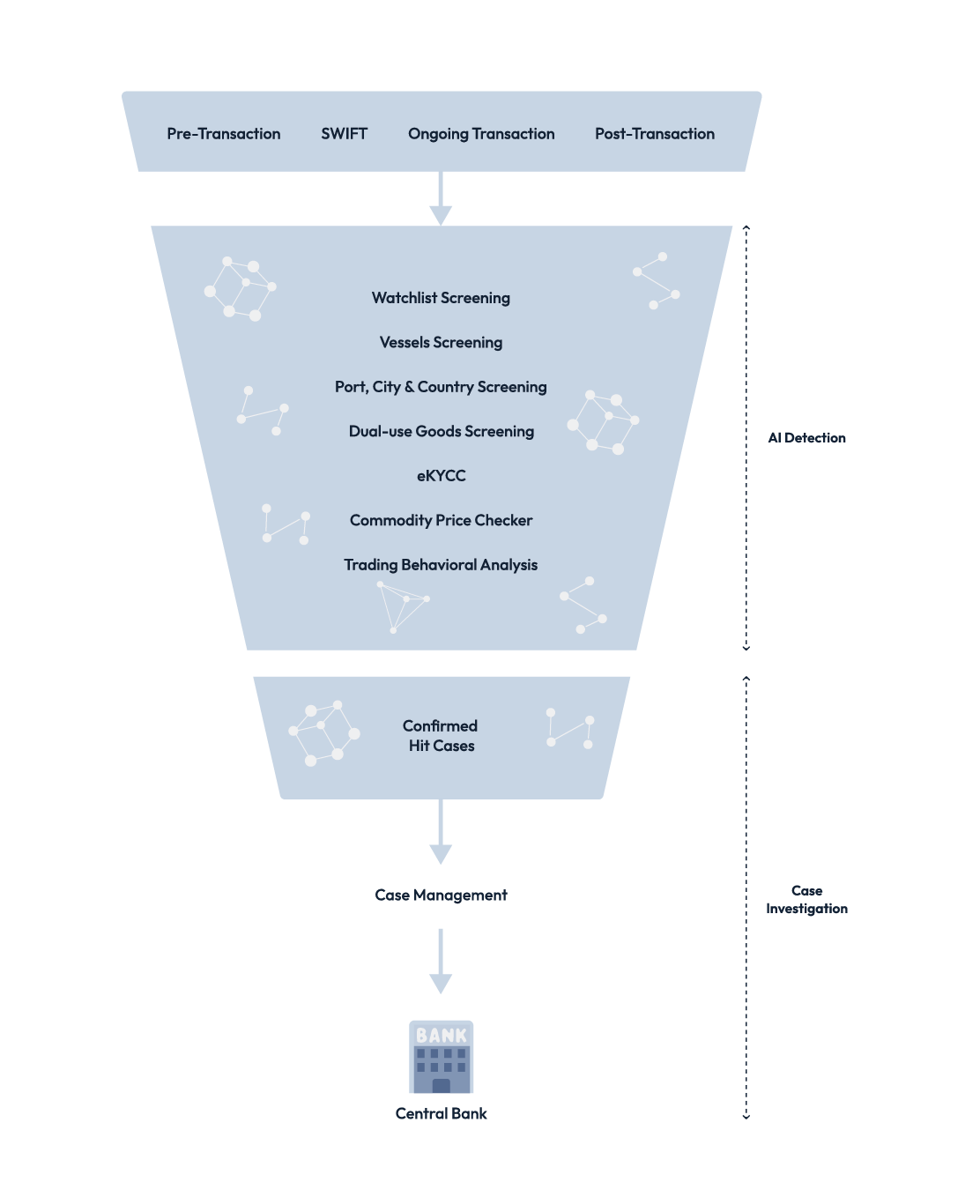

Stop Fraud, Secure Trade

Simplify trade, gain unmatched trade risk insights.

KYC Screening

AI-powered screening for trade monitoring.

KYCC Screening

AI-powered screening on the client’s customers for trade monitoring.

Case Workflow

Case workflow for on-going trade investigation.

Vessel Screening

AI-powered screening on the vessel name and identified the vessel movement illegal activity.

DUG Screening

Screening the goods being traded against of lists of dual-use items terrorist or proliferation activities.

Port & Cities Screening

Screening on ports and cities involved in trade transaction that may involve in illegal activity.

Commodity Price Detection

Identify discrepancies between the prices listed in trade transaction against the prevailing market prices.

Why use our TradeAML?

Transforming trade business process

Streamline operations and enhance trade verification with seamless checkpoint process.

Improve operational efficiencies

Optimize productivity and decision-making with unparalleled process efficiency.

Improved Regulatory Compliance

Stay ahead with the ever-changing industry and regulatory requirement to ensure ongoing compliance requirement.

Start with our TradeAML today.

Explore our other solutions

Portfolio

Transform your AML investigations with the all-in-one hub for effortless red flag management. The overview of client profiles and red flags empower your team to prioritize potential suspicious red flags and eliminate investigation redundancy while boosting operational efficiency.

Onboard Monitoring

Perform in real-time on your client onboarding process against watchlist and risk profile to make rapid decisions about onboarding the client on the go will create smooth onboarding process for your institution.

Client Profile Management

Provide seamless and comprehensive individual AML risk profile for each client on periodic basis to ensure continuity of risk-based approach for ongoing risk assessment and enhanced risk assessment.

Watchlist Monitoring

AI-powered screening engine on clients or entities against premium and public watchlist with the predictive machine-learning model help to reduce false positive and pinpoint true threats.

Tx Monitoring

Discover smarter rule scenarios with our AI-powered clustering algorithm that pinpoint truly suspicious activity and provide insights for your team to perform effective investigation and report suspicious transaction.

Tx Screening

Perform in real-time on your transactional data against watchlist or keywords to make rapid decisions about the transactions allow to proactively mitigate risk associated with cross-border payments and boost sanction compliance.

eKYC

Experience frictionless onboarding with automated verification process. The AI-powered delivers rapid decisions on identify verification and KYC solutions, keeping your digital onboarding secure and compliant without the hassle.