Fraud Monitoring

Identifies suspicious patterns, automates investigations, and provides actionable intelligence, empowering you to neutralise threats quickly and confidently, ensuring seamless protection at every step.

AI Fraud Detection & Prevention Solutions Malaysia: AI Powered Fraud Prevention

iSEM.ai provides AI powered fraud detection solutions that help institutions detect anomalies, investigate faster, and prevent losses in real time. Our platform supports fraud prevention across banking, insurance, and digital sectors while keeping operations smooth and compliant.

iSEM.ai’s fraud detection solutions in Malaysia empower financial institutions to detect suspicious transactions in real-time while maintaining a seamless transaction flow.

Real-Time Fraud Detection Solutions for Instant Risk Mitigation

Experience frictionless, real-time detection of fraudulent activities with transaction detection solutions malaysia. Our AI-powered systems analyze transactions instantly, preventing potential financial losses and ensuring your business complies with AML regulations.

Smooth Fraud Detection Monitoring with Real-Time APIs

Ensure a seamless fraud detection process with real-time REST APIs. iSEM.ai’s fraud detection solutions Malaysia integrate smoothly into your transaction systems, providing continuous monitoring while minimizing disruption to business operations.

Our impact in numbers

More than

Discover how our solution can help your business today.

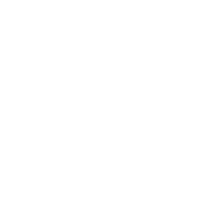

Dynamic Fraud Detection Scenario Coverage

iSEM.ai covers a wide range of fraud scenarios with real time detection. Our platform helps businesses identify and mitigate risks efficiently across industries.

Minimize False Positives in Fraud Detection

Reduce manual review by detecting real threats with precision. iSEM.ai lowers false positives to improve operational efficiency and fraud prevention accuracy.

Seamless Fraud Detection Integration

Integrate iSEM.ai fraud detection solution into existing transaction systems through real time REST APIs for fast and smooth screening.

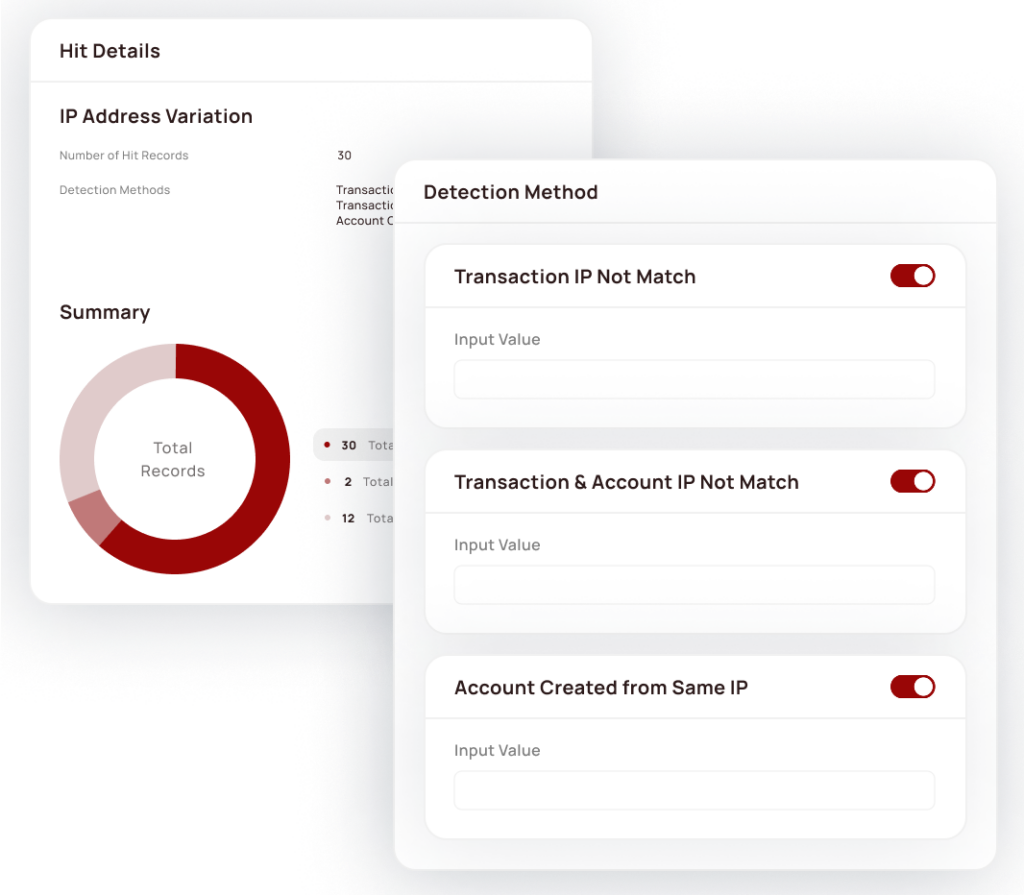

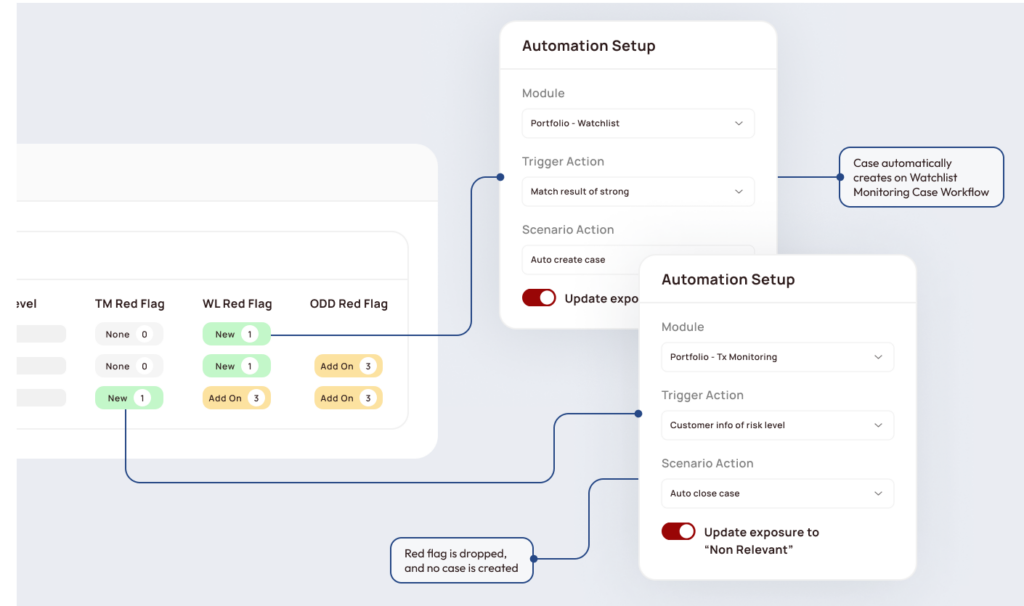

Efficient Fraud Investigation Workflow

iSEM.ai supports clear decision making through a unified interface that simplifies fraud investigation for both centralized and decentralized teams.

Definitive Intelligence, Trusted Compliance

iSEM.ai offers intelligent fraud detection solutions in Malaysia with AI-driven analysis, helping banks and insurers detect threats in real time and reduce false positives.

Portfolio

Client Risk Portfolio for Financial Institutions

Gain a centralized, real-time overview of client risk metrics, streamline investigations, and enhance financial crime prevention decisions with actionable insights.

Onboard Monitoring

AI-Powered Onboarding for Financial Crime Prevention

Simplify client onboarding with real-time watchlist screening, risk detection, and regulatory checks, designed for

compliance in Malaysia’s financial sector.

Client Profile Management

AML-Ready Client Profiling & Risk Scoring

Manage evolving customer risk profiles with AI. iSEM.ai helps you track AML activities, identify vulnerabilities, and ensure continuous compliance across financial operations.

Watchlist Monitoring

Watchlist Intelligence for Financial Crime Prevention

Instantly match client data against global watchlists and sanctions databases using AI, eliminating false positives and strengthening regulatory compliance.

Tx Monitoring

AI Transaction Monitoring to Detect Suspicious Activity

Leverage clustering algorithms to detect outliers and risky transaction patterns, enabling fast, scalable fraud prevention and AML enforcement.

Tx Screening

Real-Time Transaction Screening for Clean Compliance

Ensure every transaction complies with AML regulations. iSEM.ai screens data instantly to flag suspicious entries without slowing business operations.

Frequently Asked Questions (FAQs)

What are Fraud Detection Solutions Malaysia provided by iSEM.ai?

What are Fraud Detection Solutions Malaysia provided by iSEM.ai?

iSEM.ai offers fraud detection solutions that use AI-powered algorithms to detect and prevent fraudulent activities in real-time. Our solutions ensure that businesses comply with AML regulations while effectively mitigating financial crime risks.

How do AI Fraud Detection Solutions from iSEM.ai work in Malaysia?

How do AI Fraud Detection Solutions from iSEM.ai work in Malaysia?

AI Fraud Detection Solutions from iSEM.ai use machine learning models to analyze transaction data in real time. By identifying suspicious patterns and anomalies, our system helps businesses prevent fraud and ensures compliance with AML regulations in Malaysia.

How do Banking Fraud Prevention Solutions Malaysia from iSEM.ai protect financial institutions?

How do Banking Fraud Prevention Solutions Malaysia from iSEM.ai protect financial institutions?

iSEM.ai’s banking fraud prevention solutions help financial institutions detect and prevent unauthorized transactions in real time. By using AI and behavioral analytics, our system identifies anomalies in banking activity, protects customer accounts, and ensures compliance with Malaysia’s AML regulations.

What are the benefits of Insurance Fraud Detection Solutions from iSEM.ai?

What are the benefits of Insurance Fraud Detection Solutions from iSEM.ai?

iSEM.ai’s Insurance Fraud Detection Solutions leverage AI technology to detect fraudulent insurance claims. These solutions help businesses in Malaysia to streamline their claims process, reduce fraud risks, and ensure compliance with AML regulations for a more secure and efficient insurance system.

Powered by:

iSEM.ai is an AI-powered platform by TESS International, focused on delivering intelligent financial crime prevention and compliance solutions across Malaysia and Asia.

©2025 iSEM.ai, a product of TESS International.

All rights reserved.